Navigating the turbulent times - Digital health

Going back to first principles is the best strategy in uncertain times

BVP published an interesting report last week on growing health tech startups.

This report and views from other sources stimulated an interesting conversation with a few clients and colleagues on the state of tech enabled health, startup activity and navigating this environment. The heated funding market of 2021 (in fact 2021 saw almost 2x fund flow in digital health compared to 2020) formed the subtext for these conversations.

Is there a bubble on? I think the answer is as usual, “it depends”. Market was definitely heated last year and appears to be cooling down and become more sane now. However, if the pitch is powerful enough, there is no dearth of funding as can be seen from the recent announces (Somatus, Homeward are some that I really like in terms of focus and category they are working in).

Coming back to the main theme, the report published by Bessemer and other counter views coalesce around some interesting points:

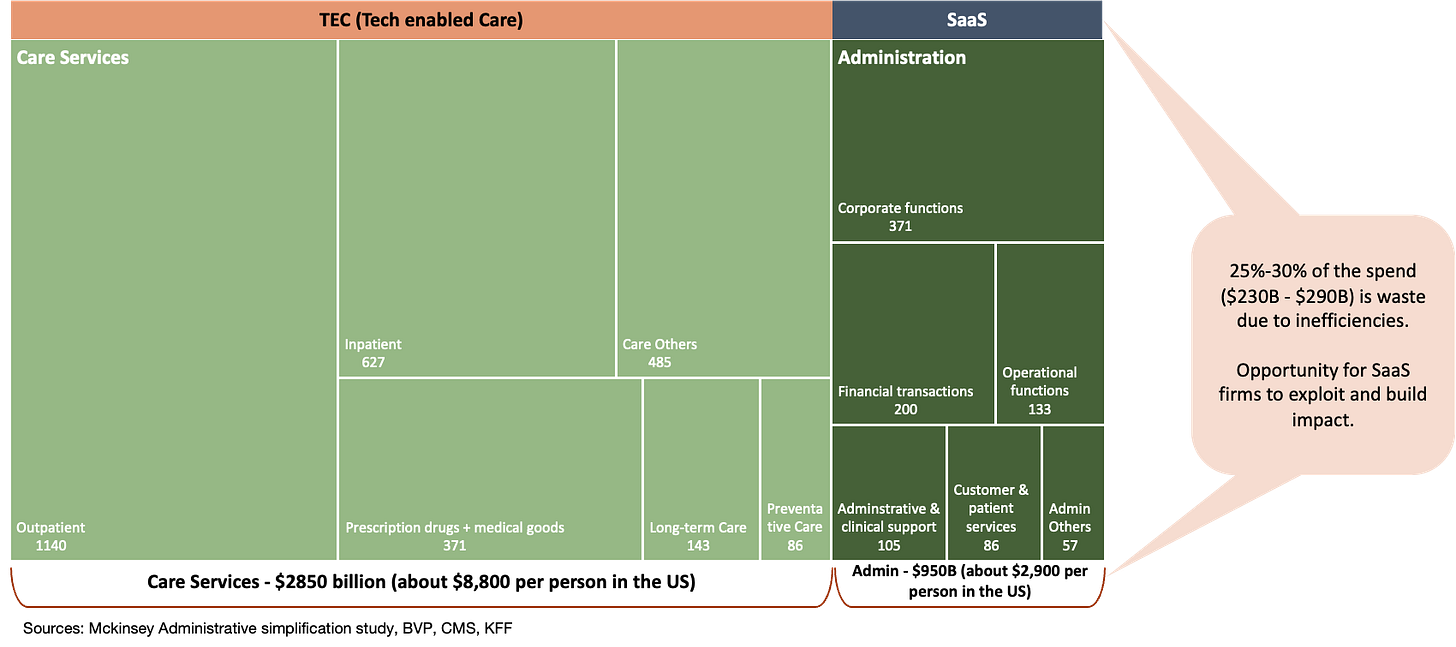

2 broad kinds of startups: SaaS that sell to primary players (payors, hospitals, practices, …) in administration functions and TEC (Tech enabled Care) that partners with primary players, but manages care delivery or management themselves.

SaaS focuses on administration layer - payment integrity, revenue cycle, automation, CRM etc. Huge amount waste waiting to be identified and eliminated here (~30% of administration costs by some estimates)

TEC focuses on care management and/or delivery. All digital health startups such as Headstrong, Homestead, fall in this category. This is the care component of US THE (Total Health Expenditure) - 75% of $4 trillion pa.

For both categories, the guidance is straightforward:

Focus on showing clear ROI (financial, clinical or operational)

Sales cycles are long and messy, be prepared and financially secure

Pure growth is so last year; now its growth and gross margins

For SaaS firms, I thought they didn’t emphasize enough the importance of reliable value proposition apart from clear ROI. My experience has been that anything that touches revenue cycle, billing and charges is incredibly sensitive in provider environment and if something goes wrong from daily transactions to month-end close, all hell will break loose from CEO on.

Apart from this minor nit, I believe the guidance to startups is very much on point.

On a different note, while this report retains some of the exuberant spirit of last year, there are counter views rising up on the bubble and value from digital health startups.

Counterview

Greylock VC recently channeled some angst on whether VCs should be funding TEC at all. The challenges are real and big:

Patients need necessarily not show consumer like behaviour (loyalty for ex) especially when the condition gets back under control

B2B2C GTM model is operating in a noisy, crowded environment (TEC firms!)

Unit economics and time to value are demonstrably worse than traditional sectors VCs operate in

Necessity to establish “evidence” for step improvement in outcomes

PCORI is investing $50+ mill to verify whether telehealth brings any value.

In closing, I believe that macroenvironment can be whatever it is, but for a team, the first principles are all that matter:

Is the problem we are solving meaningful enough and does our solution make a difference?

Do we have evidence of outcomes, ROI, efficiencies that is clear and strong?

Are our unit economics aligned to our financial objectives?

Do we have the financial strength to last a long sales cycle? If not, can we narrow our focus to make the $ last?